Table of Contents:

- Training News: Attendees pleased with new APSS courses!

- Supplier News: It’s 1099 Time Again! Here’s some good info

- T&E News: What to do if unallowable charges wind up on a One Card?

- TECH TIP: Excel trick to analyze data at a glance

Training News: Attendees pleased with new APSS courses

Training News: Attendees pleased with new APSS courses

As of January 31st, over 360 employees have attended APSS’s FY17 live instructor led course offerings, including:

- How to Pay for Goods and Services

- Employee Reimbursements in Travel & Expense Module

- Tips using the Supplier Module/creating Payment

- Open Lab Sessions

With an over 85% post-course survey response rate, we are happy to report the following:

- 93% of respondents felt that overall, training was either Good or Excellent with the vast majority being Excellent.

- 98% felt the trainers were either Good or Excellent with the vast majority being Excellent.

- 98% felt the content was either Good or Excellent with the vast majority being Excellent.

- 94% were very likely to attend future sessions offered by APSS.

We are thrilled with these percentages, especially since they are even higher than FY16. Based on how many employees have ER, Voucher, and Supplier access, there are 100’s of people on each campus who have not had an opportunity to attend yet. For live training to be effective, APSS strives for each class (session) to have at least 10 attendees.

So, we are asking for your help. If you have been to one or more of these courses and found value, please send the registration link (below) to your colleagues and encourage them to attend as well, especially those working with Suppliers, processing ERs, or creating/approving Vouchers. Or, if you have not attended yet and have any of the access types mentioned above, please click this REGISTATION LINK and sign up. Please help us to continue growing this popular training program.

Thanks so much!

~APSS Team

Here is what attendees are saying…

I don’t give compliments a lot, but this was the best by-far training class you have set up. This needs to be a mandatory class.

~FY17 “Tips using the Supplier Module / creating Payment Requests” attendee

Wish this had been offered when I first started working here. – Great Job!

~FY17 ”How to Pay for Goods and Services” attendee

I learned helpful tips that I didn’t know about regarding expense reports. Excellent Presenter.

~FY17 ”Employee Reimbursements in Travel & Expense Module” attendee

Supplier News: It’s 1099 Time Again! Here’s some good info…

While most of us are familiar with the more common 1099 MISC and W-2’s we send and receive this time of year, you may receive questions about some of the lessor known forms as well. Below you’ll find information on the forms, what they are used for, and additional resources you can access. So read on my fiscal warriors, read on…

While most of us are familiar with the more common 1099 MISC and W-2’s we send and receive this time of year, you may receive questions about some of the lessor known forms as well. Below you’ll find information on the forms, what they are used for, and additional resources you can access. So read on my fiscal warriors, read on…

What is a 1099 MISC Form used for? Per the Society for Human Resource Management, “The 1099-MISC Form is an Internal Revenue Service (IRS) tax return document used to report miscellaneous payments made to non-employee individuals during the calendar year.”

- Who gets one? Per IRS Guidelines and University Guidelines, Suppliers who have received $600 or more in miscellaneous payments or who have received $10 or more in royalty payments in a given calendar year.

- When are they sent? The Accounts Payable Shared Services (APSS) team combines several sources of data to arrive at a final list of 1099 recipients in January. This list is used to create and mail out 1099s by the end of January.

- What can I do to verify required suppliers receive accurate 1099 MISC Forms?

- Timing Advice: The payment date a voucher is paid determines which calendar year it will be included in for 1099 purposes. 1099’s may impact your Suppliers tax reporting in a given year. If you request a hold check in 2016 and don’t mail it until 2017 and your supplier does not provide their goods/services until 2017, they will receive a 1099 in 2016 (the tax year prior to when work was completed and they were paid). Similarly, if you create a voucher and payment occurs very late in December, yet the supplier does not provide their goods/services or receive payment until 2017, the same 1099 timing issue can occur. This could lead to unhappy suppliers with 2016 1099’s for goods/services they didn’t provide or get paid for until 2017.

- What can I do to prevent timing issues?

- Be aware of when you will receive a Supplier’s goods/services during this time of year. If you won’t receive their product/service until 2017, wait to create the voucher until 2017.

- If you have a hold check for goods/services you will receive late in 2016, be sure to promptly send on to your suppliers.

- If you must create a voucher in 2016 for goods/services not to be received until 2017, put “Scheduled to pay 1/5/2017” in the comments section. AP staff will see this and delay payment until 2017 which will prevent the payment from being included in 2016 1099 calculations.

- What can I do to prevent timing issues?

- Timing Advice: The payment date a voucher is paid determines which calendar year it will be included in for 1099 purposes. 1099’s may impact your Suppliers tax reporting in a given year. If you request a hold check in 2016 and don’t mail it until 2017 and your supplier does not provide their goods/services until 2017, they will receive a 1099 in 2016 (the tax year prior to when work was completed and they were paid). Similarly, if you create a voucher and payment occurs very late in December, yet the supplier does not provide their goods/services or receive payment until 2017, the same 1099 timing issue can occur. This could lead to unhappy suppliers with 2016 1099’s for goods/services they didn’t provide or get paid for until 2017.

- New Supplier Advice: Ensure you communicate why we are paying the supplier so they can be created with the appropriate 1099 withholding code.

- Non-PO Voucher Advice: Has your Department paid fees, commissions, or compensation for services to a non-employee or independent contractor? If so, there are two things you can do to ensure accurate 1099 reporting. First, review the IRS 07-Nonemployee Compensation section of THIS LETTER from the Controller’s Office. It explains what type of payments will result in a supplier receiving a 1099. Second, when creating Vouchers, please always use the comments box to document what payments are for. This helps the APSS team as they do their analysis of payments to suppliers each year. This analysis determine eligibility for 1099s and your comments when setting up suppliers and creating vouchers are a big help. If you have 1099 questions or notice an error please contact APSS Manager – Rita Carter.

- Awards, Gifts, and Prizes Advice:

Has your Department paid any Awards, Gifts, or Prizes by cash, gift card, gift certificate, or merchandise to non-employees?- If so, the amount of recordable income should be disclosed to the APSS Center before year end. If you know of Awards, Gifts, or Prizes paid out by a non-check method, please contact APSS Manager – Rita Carter.

- Research Subject Payments Advice: Has your Department paid Research Participants by cash, gift card, gift certificate, or merchandise?

- If so, the amount of recordable income may need to be disclosed to the APSS Center before year end. You can verify which research studies require 1099 reporting by reaching out to your campus’s Research Subject Payment Coordinator before the end of the year.

What is a W-2 Form used for? Per the IRS, Every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year (all amounts if any income, social security, or Medicare tax was withheld) for services performed by an employee must file a Form W-2 for each employee (even if the employee is related to the employer) from whom: 1) Income, social security, or Medicare tax was withheld. 2) Income tax would have been withheld if the employee had claimed no more than one withholding allowance or had not claimed exemption from withholding on Form W-4, Employee's Withholding Allowance Certificate.

- I have W-2 questions. Who can I speak with?

- University of Missouri-Columbia & University of Missouri System - Payroll Office

- University of Missouri-Kansas City - Payroll Office

- Missouri University of Science & Technology - Payroll Office

- University of Missouri-St. Louis - Payroll Office

What is a 1098-T Form used for? Per the IRS, if you are an eligible educational institution, you must file for each student you enroll and for whom a reportable transaction is made.

- Where do my students go for questions or to get a 1098-T reprint? To their campus’s Cashiers website – click on “Tax Info” and select Reprint 1098-T. Campus specific Cashier’s Office websites are listed below:

- University of Missouri-Columbia - Cashier’s Office Website

- University of Missouri-Kansas City - Cashier’s Office Website

- Missouri University of Science & Technology - Cashier’s Office Website

- University of Missouri-St. Louis - Cashier’s Office Website

What is a 1099-R Form used for? Per the IRS, for each person to whom you have made a designated distribution or are treated as having made a distribution of $10 or more from profit-sharing or retirement plans, any individual retirement arrangements (IRAs), annuities, pensions, insurance contracts, survivor income benefit plans, permanent and total disability payments under life insurance contracts, charitable gift annuities, etc.

- Where do retirees go for questions regarding this form?

- Go to my Total Rewards or click HERE for answers to FAQ’s

- Where does one go to get a reprint of this form?

- Go to the UM System HR Service Center

What is a 1095-C Form used for? Per the IRS, this form will include information about health insurance coverage offered to you, your spouse and your dependents by the University of Missouri. Its purpose is to assist you in completing your income tax return. For more information about this form, click HERE.

T&E News: What to do if unallowable charges wind up on a One Card?

Now that the whole University System has switched from the old Purchasing Card (Pcard) and Travel Card programs to the newly combined One Card program, there are some key differences to understand. An article was written in the last newsletter covering these differences.

Now that the whole University System has switched from the old Purchasing Card (Pcard) and Travel Card programs to the newly combined One Card program, there are some key differences to understand. An article was written in the last newsletter covering these differences.

One of the key things to watch for is a temporary uptick in unallowable charges. Since there are changes to what is an allowable charge on the One Card regarding travel expenses, this could be a source of confusion initially. Previously, hotel incidentals, personal meals that will be covered by per diem reimbursement, and gasoline for personal vehicles could be charged to the travel card. These expenses are not allowed on the new One Card. As always, anything that does not pertain to University business should not be charged to the card. If you’d like to learn more about allowable versus unallowable purchases while using the new One Card program, please click HERE.

Even though the new rules have been communicated to all cardholders, employees who had Travel Cards (individual liability) may not remember. As such, they may make unallowable charges without realizing it. There could even be instances where someone accidentally uses the wrong card when making purchases.

If you discover an unallowable charge(s), on a One Card, what should you do? Follow the steps below:

- Familiarize yourself with the overall correction process by reading THIS document.

- Go to PeopleSoft => Employee Self-Service => One Card Reimbursement => Add a New Value

- click on the “Instructions” tab and review

- click on the “Form” tab, complete, and save the form

- click on the “Attachments” tab, upload supporting documentation

- submit the form

- Using functionality within PeopleSoft Travel and Expense, APSS will financially document the unallowable charge. You will receive notifications after you submit the One Card Reimbursement form.

TECH TIP: Excel trick to analyze data at a glance…

![]() If you are a frequent excel user, you’ve very likely discovered all sorts of ways to manipulate numbers and other data to find answers. Sometimes, you don’t need elaborate formulas, tables, and charts though. You just need to know the sum of a column of numbers or a few cells. Or, maybe you just need the average of a set of numbers. Perhaps it would be helpful to know the lowest are highest value in a set numbers. One quick way to obtain these answers is to customize your “Status Bar”.

If you are a frequent excel user, you’ve very likely discovered all sorts of ways to manipulate numbers and other data to find answers. Sometimes, you don’t need elaborate formulas, tables, and charts though. You just need to know the sum of a column of numbers or a few cells. Or, maybe you just need the average of a set of numbers. Perhaps it would be helpful to know the lowest are highest value in a set numbers. One quick way to obtain these answers is to customize your “Status Bar”.

Let’s say you are working with an excel spreadsheet, but instead of just a few cells like the images below, let’s pretend the amount of data you need to analyze is gigantic. Let’s say you’d like to know:

- The smallest number in range A2-A9

- The largest number in range A2-A9

- The # of numerical and non-numerical values in range A2-A9

- The total of all numeric values in range A2-A9

- The average of all numeric values in range A2-A9

You excel settings can be changed so all you have to do is highlight cells A2-A9 and all of this information will display automatically at the bottom of your screen in the green area called your “Status Bar”. Here is how you do it:

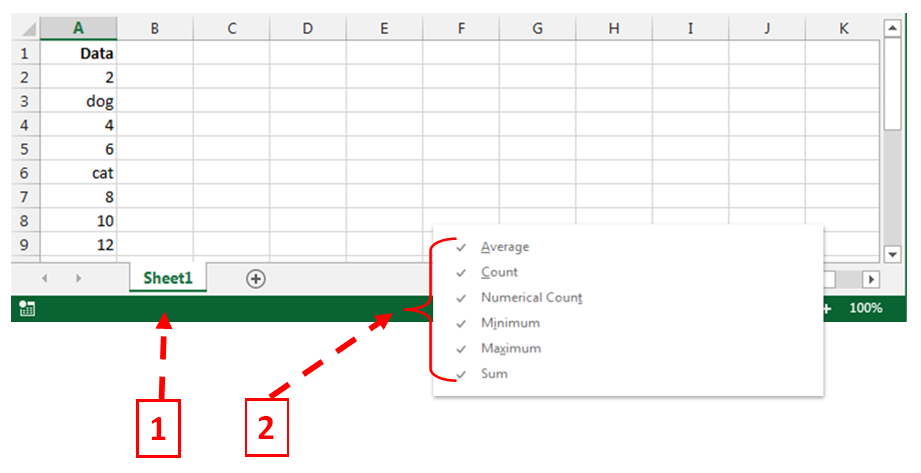

Step 1: right click in your status bar and a popup will open.

Step 2: make sure the following are checked: Average, Count, Numerical Count, Minimum, Maximum, and Sum

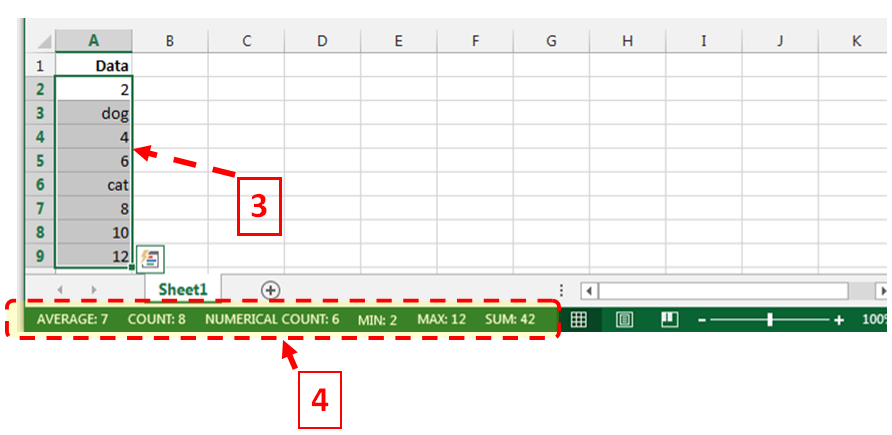

Step 3: highlight the cells you wish excel to make calculation on. In this case, A2-A9.

Step 4: And voila… your results will automatically calculation in the “Status Bar”.

Reviewed 2020-03-02