Table of Contents:

- T&E News: One Card Reconciliation changes are coming

- T&E News: When should I use the Miscellaneous Expense Type?

- PO Voucher News: Where do I route my PO questions?

- Non-PO Voucher News: What’s PII and how can it hold up payment requests?

- TECH TIP: Speeding up formatting tasks in Excel

T&E News: One Card Reconciliation changes are coming

Moving the reconciliation to T&E will replace a manual, paper based process with an automated, electronic workflow approval process consistent with other payable transactions at the university. Other benefits include storing receipts with the transaction in PeopleSoft, chartfield validation at data entry, and the ability to track approvals and processing of the One Card transactions.

The transition from PaymentNet to T&E will occur at the end of October 2017 after the October billing cycle is complete. Learn more about One Card reconciliation changes with newly available training opportunities.

T&E News: When should I use the Miscellaneous Expense Type?

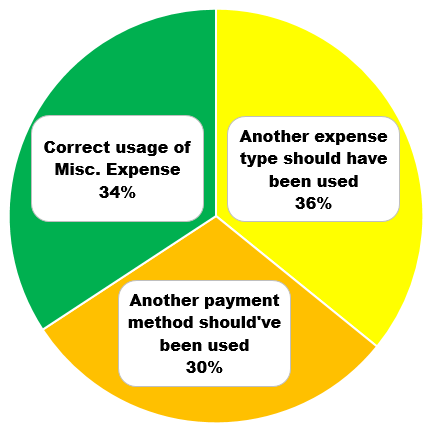

All FY17 transactions using the Miscellaneous Expense type were reviewed recently. To frame the discussion, let’s define the meaning of the word Miscellaneous. It means a group of items of mixed characteristics. In terms of the Travel & Expense module (T&E), if there were an expense type for every type of transactions, there’d be so many that you couldn’t find what you are looking for. On the other hand, too few categories does not serve the purpose of communicating needed information to understand the nature of all our transactions. So a balance had to be struck. As such, when T&E was set up, the goal was to provide categories for the most common 80% of transactions used by our campuses. Thus, Miscellaneous Expense was needed to help cover the approximately 20% of transactions not commonly used.

During FY17 Miscellaneous Expense type was used 6,596 times within ER’s.

The good news:

A third of the transactions (34%) used Miscellaneous Expense type correctly. The following are examples of travel expenses that you would typically use the Miscellaneous Expense type:

- Bank/Credit Card Transaction Fees

- Dry Cleaning for extended foreign travel

- Visa/Passport Fees

The bad news:

Two third of transactions (66%) used Miscellaneous Expense type incorrectly. They broke down into two major categories detailed below.

A third of the time (36%) the Miscellaneous Expense type was used when another more appropriate expense type already existed within T&E. The correct expense type needs to be selected to make sure we are in compliance within BPM polices, have obtained all approvals/documentation for reimbursement, and appropriate financial statement presentation. For example, moving expenses reimbursed through T&E using the Moving Expense type will route for approval to the fiscal reviewer and APSS and then are converted to an Additional Pay form for appropriate W-2 reporting for the employee. If the wrong expense type is selected this prevents the correct approvals from being obtained and tax reporting.

Below are some common areas where Miscellaneous Expense was used when another expense type should have been used.

| Actual Expenditure | Expense Type |

| Baggage Fee | Transp - Baggage Fees |

| Meal with Donors | Meal - Business |

| Hotel Room for 3 days | Hotel |

A third of the time (30%) the Miscellaneous Expense type was used when another form of payment should have been used while in non-travel status, such as a One Card, requisition, or payment request. These are instances where the Payment Reference Guide should have been referenced prior to acquiring the goods/service to check if the expense was allowable, if additional documentation or approvals were necessary, or if there was more information in a policy. The recommended payment method also considers the tax reporting implications of the transaction and how this information is gathered by APSS for reporting to the IRS. Many times this error is identified by a T&E entry delegate or the fiscal reviewer. If the employee did not have the appropriate delegation of authority to enter in the transaction, the employee may be personally liable and the University would not be obligated to authorize the reimbursement in accordance with BPM 301. If the department does authorize the reimbursement, use the transaction as a training opportunity for your department and consult APSS with concerns. The following examples should be paid with an alternate payment method.

Below are some common areas where the payment method errors occur:

- Services – Requisition or Payment Request with contract, if meets threshold

- Honorarium – Payment Request with contract, if meets threshold

- Software – One Card or Requisition depending on amount and requires IT Approval

- Subscriptions – One Card or Payment Request

PO Voucher News: Where do I route my PO questions?

Last fiscal year, there was a renewed focus on ensuring purchases were utilizing the Requisition → to PO → to PO Voucher → to Payment process when appropriate. Anytime change takes place, questions arise. So we’ve tracked, categorized, studied, and learned from your questions. This has helped us understand there is a need for guidance regarding which departments are best equipped to field certain types of questions.

In other words, let’s say you have a Requisition, PO, or PO Voucher question. Some of the contenders who could help answer your question are UM Finance Support Center, Accounts Payable Shared Services, and Supply Chain. All of these entities are involved with different parts of the process to ensure adequate segregation of duties and may or may not have your answer. So, which one should you call? Based on your most frequently asked questions, we’ve developed a chart to guide you to the right department.

Non-PO Voucher News: What’s PII and how can it hold up payment requests?

So what is PII? I can tell you it is not a big mustached guy in a Hawaiian shirt driving a Ferrari around catching bad guys back in the 80’s.

It is actually personally identifiable information (PII). We have to be careful PII is not included in supporting documents required for our payment requests. True, invoices, contracts and other source documents are required, but if they contain PII, it should not be visible on the version submitted with your payment request. This would include any form of personally identifiable information (PII) such as SSNs, financial account numbers, medical information and even DOB.

As employees, it is our responsibility to make sure the University collects PII only when necessary and secures what has been collected appropriately. For the purpose of payment requests, please redact any PII information that might be included on an invoice or contract before uploading and attaching as support. Also keep in mind that an individual’s W-9 needed for new supplier requests must not be attached to payment requests. Minimizing proliferation of sensitive PII will reduce the risk of privacy incidents and also speed up the process of getting your voucher approved. Get guidance related to specific PII questions.

TECH TIP: Speeding up formatting tasks in Excel

Hypothetically, let’s say you are creating a new excel document with 5 tabs. Each tab will contain a different report and they all need to be formatted to print. Unfortunately, Excel can’t read our minds to know how we want our data displayed (i.e. column and row widths/heights, fonts, borders, shading, etc.) and it doesn’t know what we want to print and not print. As a result, if you were working on this hypothetical worksheet, would you format every tab individually? Depending on how uniform your tabs are, there is a trick to do it all at one time!

For demonstration purposes, let’s say you want to do three things:

- You want the print area of each tab to print to be A1 to D50,

- On each tab, you want all cells in your print area to have borders,

- On each tab, you want all cells in your print area to have a red font.

Here’s what you do:

- Highlight cells A1-D50 on Sheet 1 and then click PAGE LAYOUT > Print Area > Set Print Area. From here you have an option.

- You could do your formatting on Sheet 1 now, such as resizing columns and rows, adding gridlines, manipulating fonts, etc, then right click Sheet 1 > click “Move or Copy” > Check the “Create a Copy” box > and repeat as many times as you need tabs. This would make clone copies of your first tab as many times as you like.

- You could wait to do your formatting but set your print area on Sheet 1, then make copies of the tabs as described in step “a” so the print area on each tab is the same. Then once all your tabs are created, you could Click on Sheet 1, hold down the “Control” key on your keyboard and click Sheets 2-5. This would select all the tabs at one time. From there you could do your formatting and it would edit all the tabs the same way at the same time.

Depending on what you are trying to accomplish, 1a or 1b might work better.Experiment around and hopefully this will save you some time.

Reviewed 2019-08-05